What's In It For You? The Goldmine in Your Backyard

Embracing retirement mortgages for purchase or refinance transactions isn't just about helping your clients—it's also a strategic move for your business. Here’s how it can benefit you:

- Generate More Revenue: By expanding your service offerings, you can increase your income through additional transactions and larger commissions from increased purchase prices.

- Increase the Likelihood of Sales: Seniors who understand their options are more likely to sell, potentially leading to 2-3 transactions, such as double ending a listing by representing the seller in their purchase.

- Create More Value: Offering innovative solutions positions you as a knowledgeable and valuable resource to your clients.

- Differentiate Yourself: By specializing in retirement mortgages, you can establish a unique selling proposition (USP) that sets you apart from other realtors.

- Help Others: Assisting senior homeowners in unlocking their home equity can significantly improve their financial wellbeing and quality of life.

- Build Trust and Loyalty: By becoming a trusted resource, you can foster long-term relationships and repeat business

The Money in Their Walls

They Don’t Know What They Don’t Know

For many homeowners, their home represents their most valuable asset. With retirement mortgages, senior homeowners can unlock the equity in their homes and turn it into a financial resource. This opens significant opportunities, especially for realtors looking to expand their service offerings and add value to their senior clients. By understanding and leveraging retirement mortgages, realtors can help senior homeowners "find the money in their walls."

One of the biggest challenges senior homeowners face is a lack of information about the options available to them. They might not know that a retirement mortgage can allow them to:

One of the biggest challenges senior homeowners face is a lack of information about the options available to them. They might not know that a retirement mortgage can allow them to:

- Buy their dream home without monthly mortgage payments.

- Replenish or add to their income-earning assets.

- Qualify more easily for a home loan.

- Make payments only if and when they choose—or never at all.

- Access a Home Equity Line of Credit (HELOC) that grows at a rate of 7.5%.

- Create an additional bucket of savings for future needs.

As a realtor, you have the unique opportunity to educate your clients about these benefits and help them make informed decisions about their financial future.

Statistics

The market potential for retirement mortgage loans is substantial:

- Over 50 million people in the U.S. are 65 years or older.

- Every day, 12,000 people turn 62.

- More than 75% of these individuals are homeowners.

These numbers illustrate the vast opportunity available in this demographic. As the senior population continues to grow, so does the potential for realtors to offer solutions that meet their unique needs.

Create Your Market

By tapping into the retirement mortgage market, you have the opportunity to create your niche and establish yourself as a leader in this growing field. As more seniors seek out ways to enhance their retirement, realtors who understand and can explain the benefits of these loans will be well-positioned to serve this market and grow their business.

Senior homeowners represent an untapped market, often unaware of the financial potential locked in their homes. Many of them may not realize how retirement mortgages can enhance their financial stability and lifestyle.

Your Marketing Strategy

Our Lifetime Home Loan program presents a unique opportunity for realtors and loan officers to collaborate, leveraging tailored marketing strategies that educate and engage homeowners aged 62 and older. This approach fosters long-term client relationships and opens the door for multiple transactions.

Maximizing Opportunities for Two Transactions

By introducing the Lifetime Home Loan, realtors can assist homeowners in accessing their home equity while positioning themselves for two potential transactions:

- The Sale – Helping clients sell their current home and transition into a more suitable property.

- The Purchase – Facilitating a new home purchase using a Lifetime Home Loan, making homeownership more affordable in retirement.

Targeted Direct Mail Strategy

We provide a strategic direct mail campaign designed to reach homeowners who are:

- 62 years or older

- Have at least 35% equity in their home

- Have lived in their home for 15+ years

This ensures messaging reaches qualified homeowners who can benefit from the program.

Marketing Materials for Realtor Success

To support realtors in capturing leads and educating potential clients, we offer:

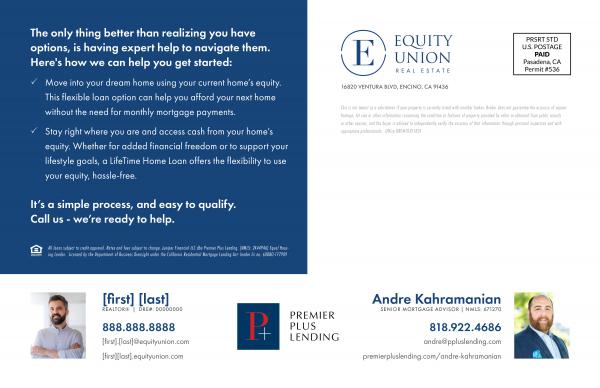

B2C Flyers – Informative, co-branded flyers designed for client outreach.

Scripts – Proven scripts for phone calls, presentations, and in-person conversations.

Farming Letters – Personalized letters to establish credibility and spark interest.

Door Hangers – Eye-catching materials to generate leads in target neighborhoods.

|

|

|

|

By integrating these tools into your marketing efforts, you can position yourself as a trusted resource for senior homeowners and gain a competitive edge in this growing market.

¹For the loans presented I am a Mortgage Broker only, not a mortgage lender or mortgage correspondent lender. I will arrange loans with third-party providers but do not fund the loans directly. I will not make mortgage loan commitments for these loans..

²There are some circumstances that will cause the loan to mature and the balance to become due and payable. The borrower is still responsible for paying property taxes, homeowner’s insurance and maintaining the property to HUD standards. Failure to do so could make the loan due and payable. Credit is subject to age, income standards, credit history, and property qualifications. Loan rates, fees, terms, and conditions are not available in all states and subject to change.

³Borrowers should seek professional tax advice regarding reverse mortgage proceeds.

*Borrowers must continue to pay property taxes, homeowner’s insurance, and home maintenance costs.